- Traders are preferring to take a long position in contrast to the sustained decline in BTC’s price

- Whales’ action could trigger a bull trend but short liquidations remain at a minimum

Bitcoin [BTC] traders seem unperturbed about the king coin’s drop below $22,000. In fact, according to CryptoQuant’s evaluation of the market, traders in the derivatives market are keen on opening long positions despite the glaring bearish exposure.

How much are 1,10,100 BTCs worth today?

Shorts gains may only last short-term

The community-driven analytics platform opined that the surprising positive sentiment could be linked to the bull/bear market cycle indicator. The metric is characterized by the aggregate view of daily market participants and often corresponds with the economic cycle.

Although BTC’s price might not reflect the status, CryptoQuant confirmed that the metric is now in the bullish domain. Its report read,

“The Bull/Bear Market Cycle Indicator remains in the bull territory, and the On-chain P&L Index momentum has entered more sustainable levels”

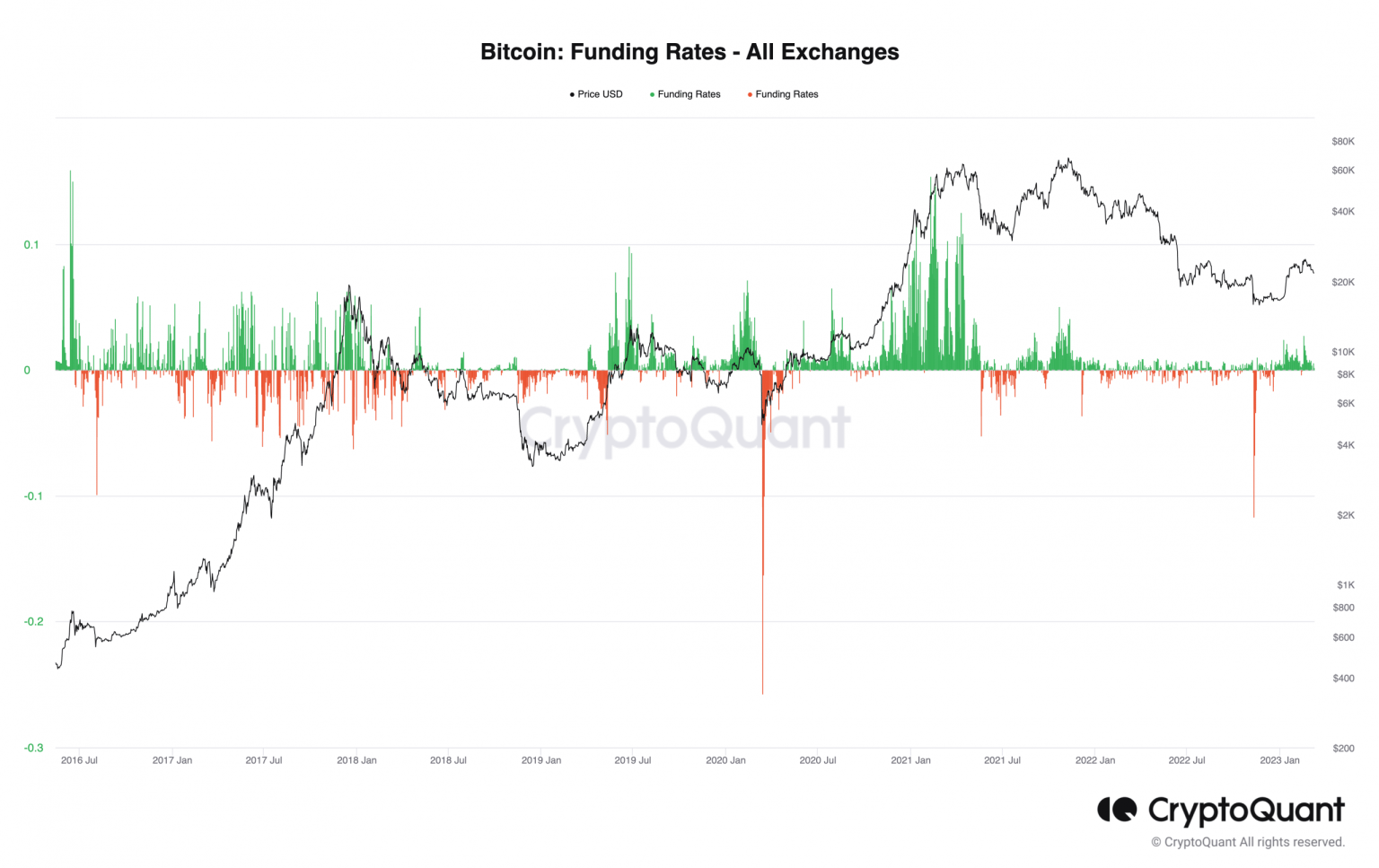

Traders’ bias has also translated into action, as evidenced by the funding rates.

Funding rates are periodic payments made to longs or shorts based on the difference between the perpetual swaps and current spot prices.

Source: CryptoQuant

At press time, the Bitcoin funding rate was 0.0018. The metric, being positive, implied that long-positioned traders were dominant in the derivatives market. As such, they have been willing to pay funding to short positions.

Furthermore, Bitcoin whales seem to be helping the cause because their usual spending in correction periods has been low, compared to previous cycles. Low sell pressure from these deep-pocket investors could help resist the downside. CryptoQuant’s assessment further confirmed,

“Previously, whales spent over 500k BTC a day during or before price corrections, but now they chiefly spend below 150K BTC in daily terms.”

Settling the storm might be…

However, the optimism projected by traders would not automatically wash away the prevailing existence of the reds. In fact, the report went on to claim that it could be profitable for traders to exercise restraint.

This, because the latest BTC correction correlated with miners and Short Term Holders’ (STH) activities. For instance – According to CryptoQuant, Miners’ BTC transfers to exchanges earlier in the month pointed to selling pressure linked to huge amounts of the coin.

Is your portfolio green? Check the Bitcoin Profit Calculator

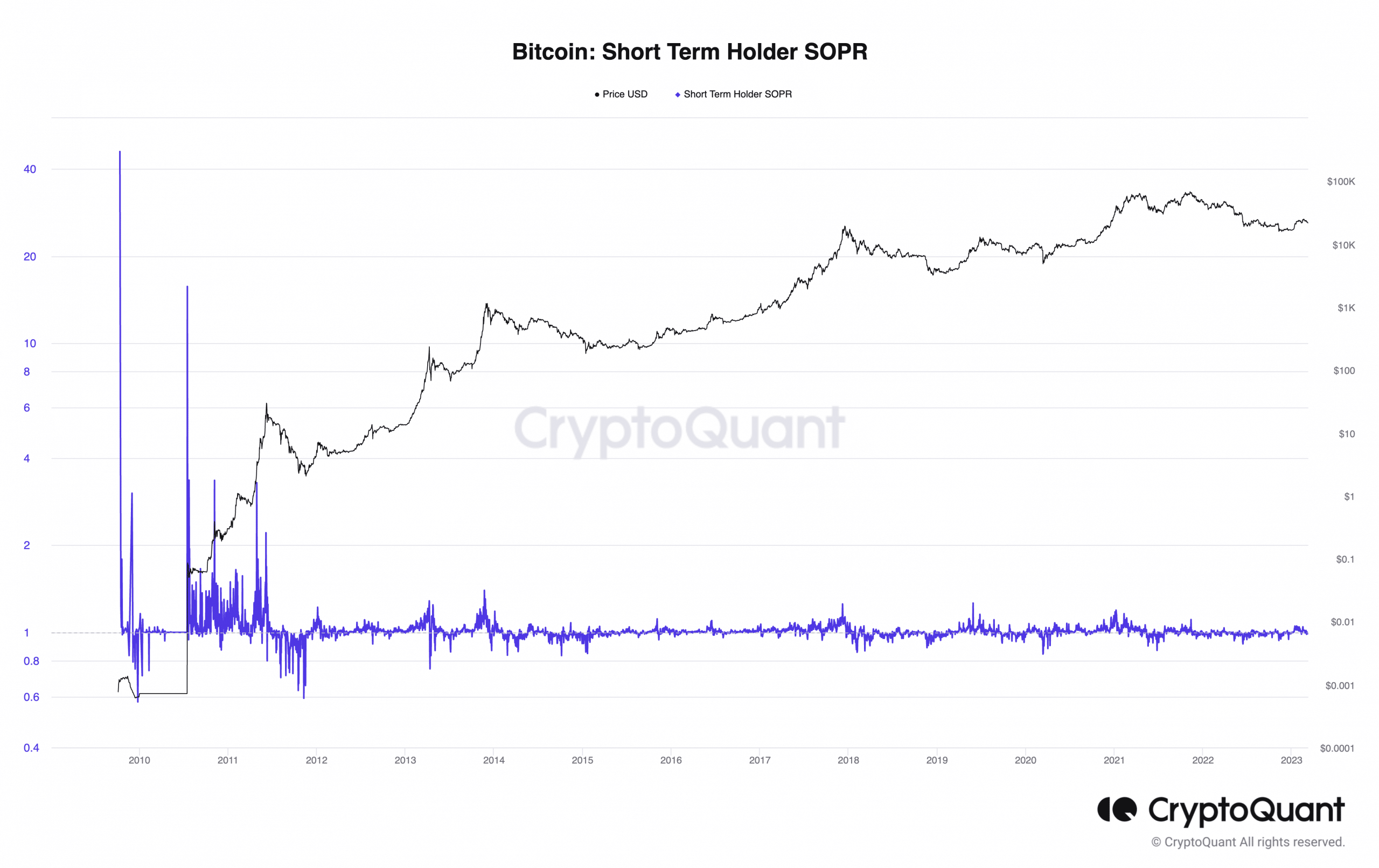

Additionally, BTC STHs took profit as the Spent Output Profit Ratio (SOPR) hit 5%. The SOPR accounts for profits or losses taken within a 155-day window.

With the metric value above 1, it means more short-term investors have been selling at a profit.

Source: CryptoQuant

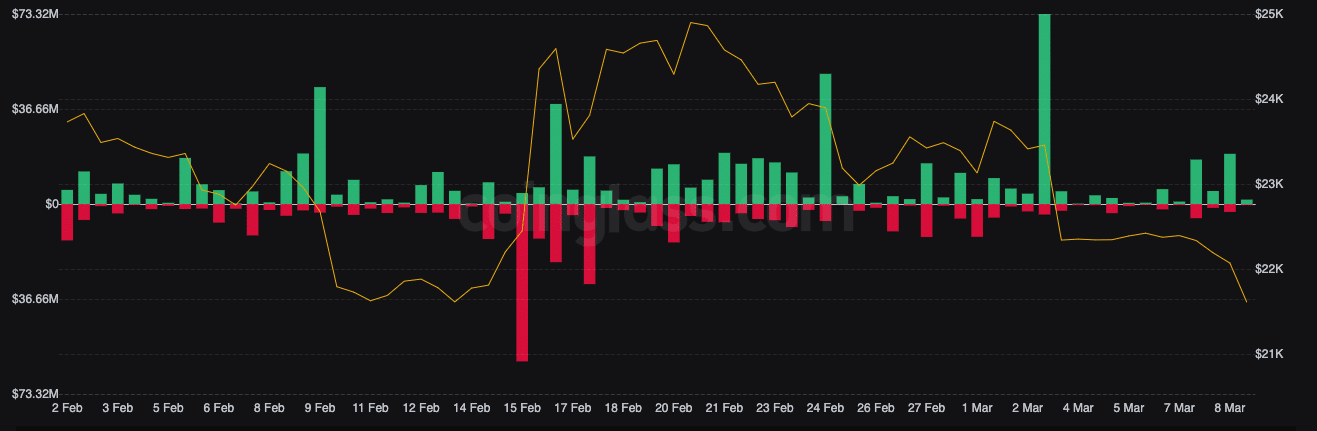

Despite the enthusiasm shown by BTC longs, however, they took a huge share of the liquidations of 8 March.

Shorts were, however, not exempted. Even so, Coinglass data revealed that long-positioned traders suffered a $19.37 million wipeout out of a possible $25.23 million.

Source: Coinglass