- U.S. government-seized Bitcoin holdings started to move, causing FUD

- Short-term holders declined while long-term holders stayed put

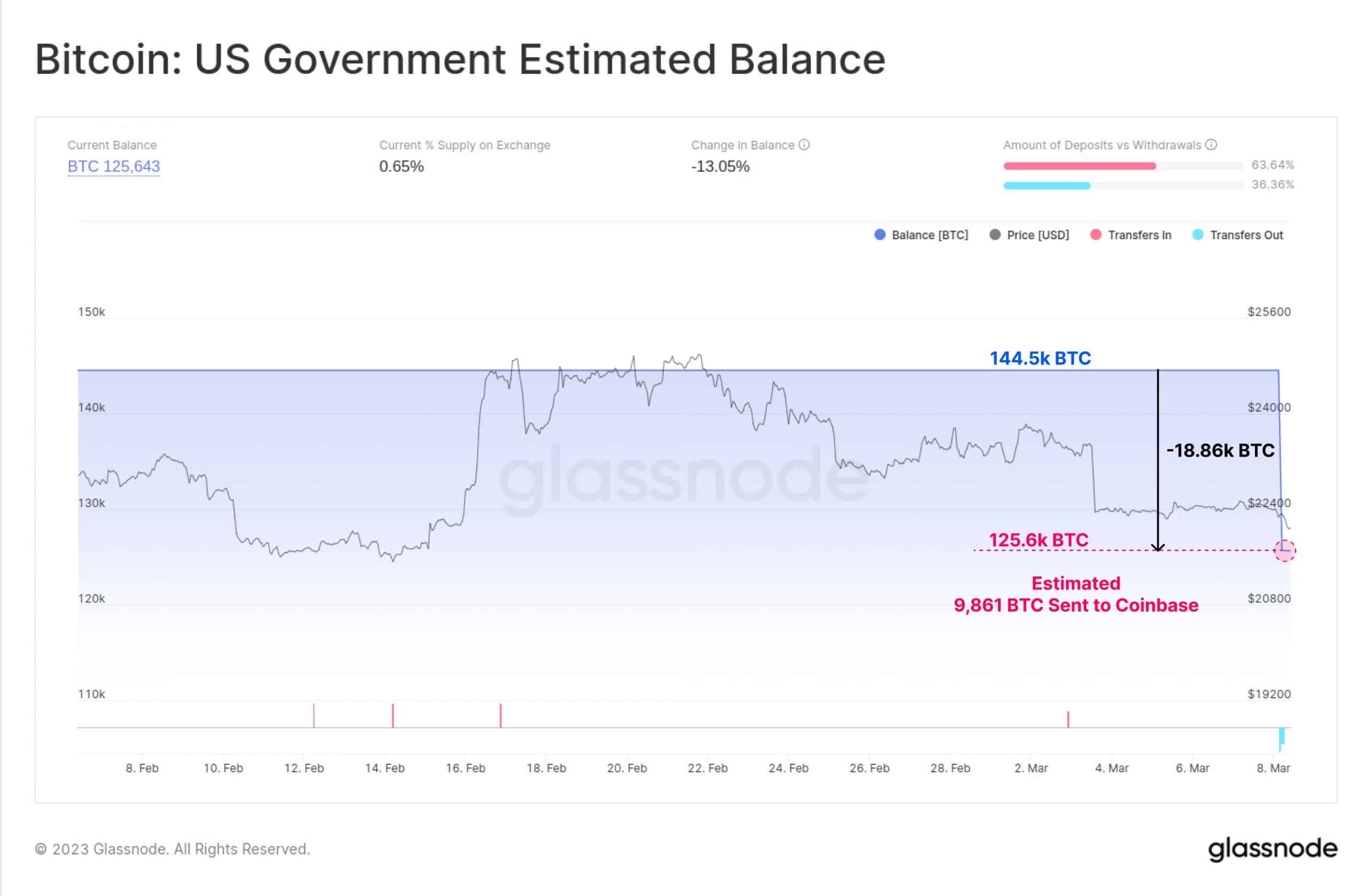

Over the last few years, the U.S. government has accumulated massive amounts of BTC for law enforcement purposes. This BTC, for the most part, has remained dormant throughout the time it was being held by the U.S government. However, according to new data provided by Glassnode, this BTC has now started to move.

Read Bitcoin’s Price Prediction 2023-2024

The amount of Bitcoin which is on the move is estimated to be around 40k BTC. Out of the aforementioned volume, 9,861 BTCs were seized from the Silk Road hacker and have been sent to a Coinbase cluster.

Source: glassnode

The FUD begins

This behavior of the U.S. government has led many members of the crypto-community to speculate on what this could mean for Bitcoin. Many users are under the assumption that the U.S. government will be selling these BTC holdings, negatively affecting the value of the cryptocurrency in the process.

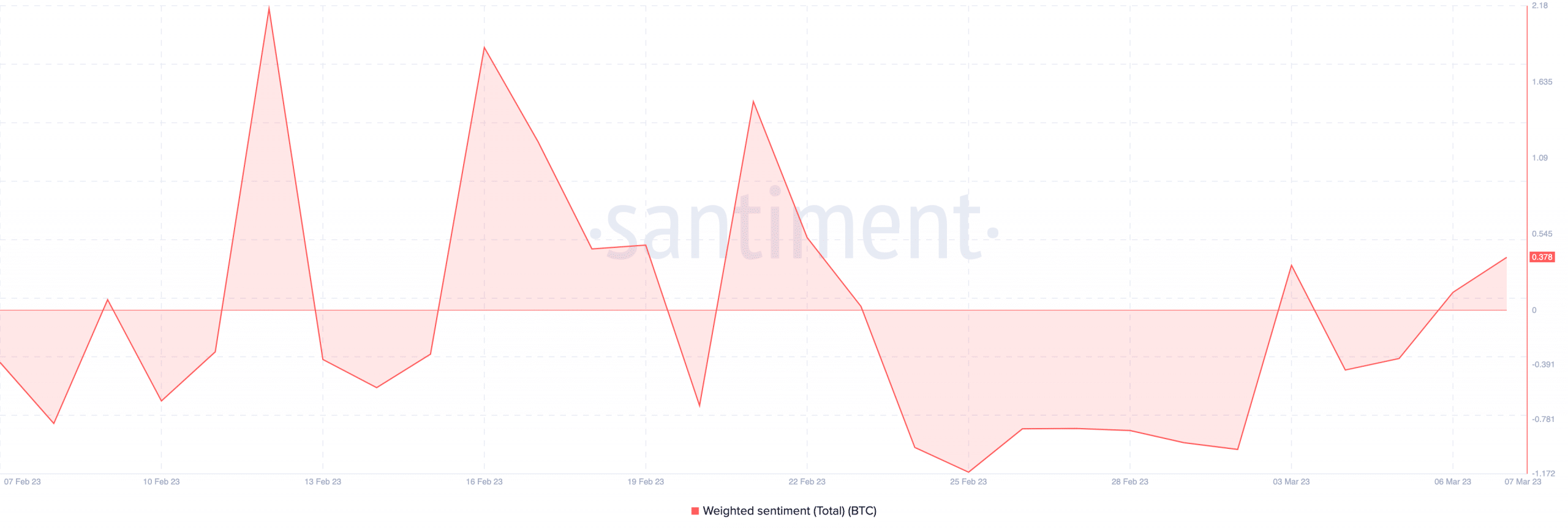

Additionally, this move by the government can harm the sentiment around BTC and cause more FUD.

At press time, the overall weighted sentiment around Bitcoin was slightly positive. However, if the FUD continues to spread, things might take a turn for the worse and the selling pressure on BTC holders would end up increasing.

Source: Santiment

Even though the FUD around Bitcoin has been on the rise, long-term holders are less likely to be affected. Based on the declining long/short ratio, it can be observed that short-term holders of BTC have started to exit their positions. The MVRV ratio for the remaining long-term holders is negative, implying that they wouldn’t be able to sell their holdings for a profit during this period.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Therefore, it is more likely that these long-term holders will continue to hold on to their assets until selling their holdings is profitable. The declining velocity is also a sign that a majority of BTC addresses have been HODLing.

Source: Santiment

Any positive, hopeful signs?

However, one of the reasons why addresses could be optimistic about Bitcoin’s future would be its performance against other real-world assets. According to analysts, for instance, Bitcoin has managed to outperform assets such as gold, silver, U.S equities, and the U.S Dollar index.

All the hysteria with the markets pricing in 50 bps for March.

A terminal Rate of 5.6% in October, higher for longer calls.

Triple-digit inversion, and most inverted since 1980. While an ongoing Grayscale case with the SEC. #Gold and #Silver are getting crushed. #Bitcoin is… https://t.co/n9muCqdh86 pic.twitter.com/Jc1m417Ym4— James V. Straten (@jimmyvs24) March 7, 2023

It remains to be seen whether Bitcoin continues its trajectory of outperforming various asset classes and whether BTC holders are impacted by the FUD.

![Bitcoin [BTC] FUD takes centre stage as Uncle Sam makes a move](https://patrolcrypto.com/wp-content/uploads/2023/03/FqpxoJhaAAEXmPH-scaled-1536x1004.jpeg)