- YFI has increased by almost 18% in the last couple of days.

- There have also been heightened activities in daily active addresses.

On 3 March, most cryptocurrencies reported losses, but Yearn Finance (YFI) appears to have broken free from the general trend. The price movement indicated that it was trading profitably, adding to the days when it had closed trades profitably.

Realistic or not, here’s YFI’s market cap in BTC’s terms

Yearning for the top

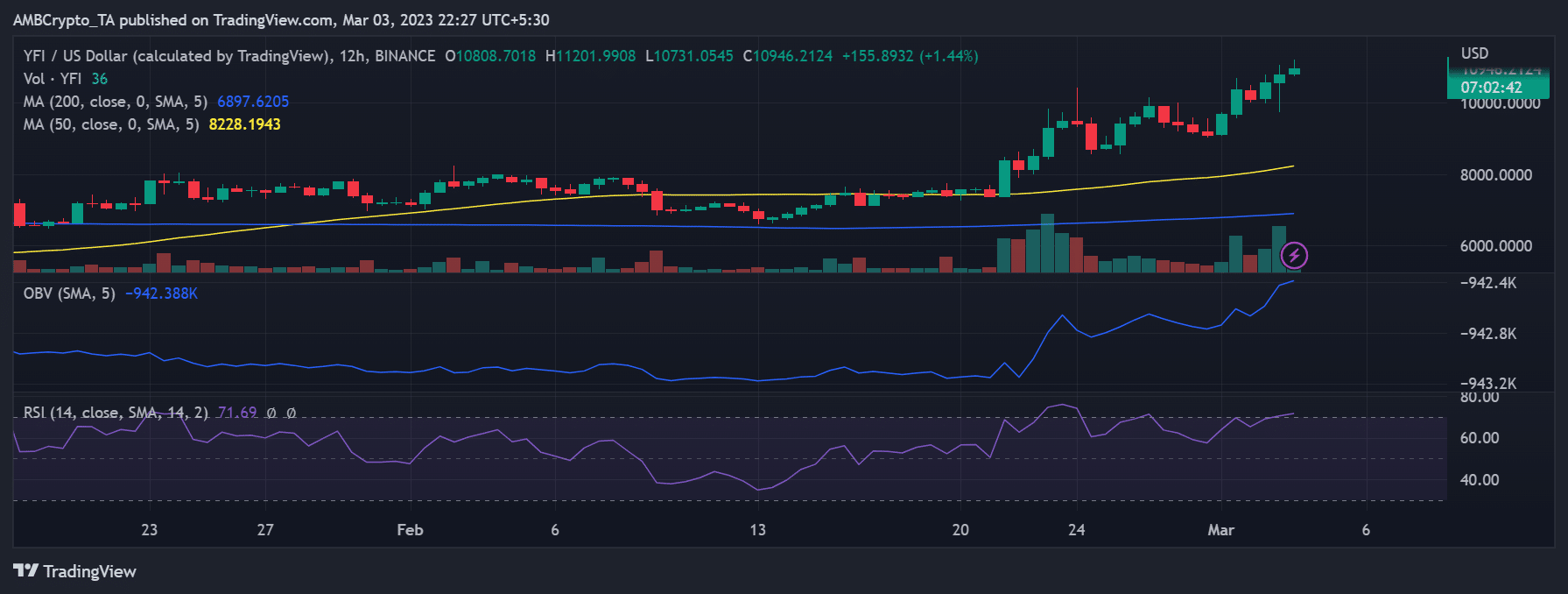

On a daily time frame chart, Yearn Finance (YFI), at press time, was trading at roughly $10,900. It was trading at a profit of more than 2%, marking the third consecutive day it had done so.

Except for one day, it had traded profitably for the previous six days, bringing its overall gain to approximately 18%.

Source: TradingView

YFI had entered the overbought area due to the enormous price spike it was experiencing. Yearn Finance’s Relative Strength Index (RSI) line was over 70, suggesting a strong bull trend (YFI). As seen by the On Balance Volume, there was also a hint of price and volume convergence (OBV).

Active address post yearly high

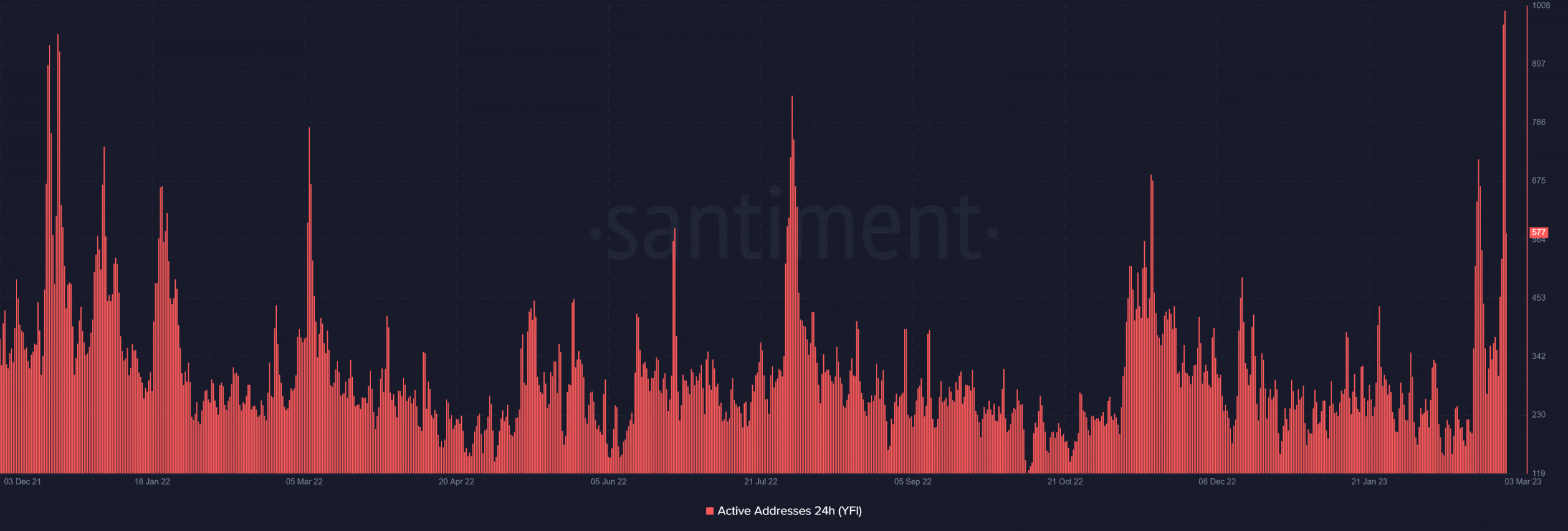

The 24-hour active address measure revealed that Yearn Finance (YFI) had seen a high activity level consistent with the pricing.

There appeared to be a rise on the daily chart, and as of this writing, there were 578 active addresses.

It was also possible to observe that the levels reached over the previous two days were the highest in over a year.

Source: Santiment

A possible reason for the pump

The announcement made by Yearn Finance last week is among the more plausible explanations for the sustained rise of YFI.

Yearn Finance revealed in a post in February that it would introduce Ethereum Liquid Staking Derivative (LSD).

As it aids in risk reduction and diversification, this kind of investment has been increasing in popularity.

Even when other assets are on a downward trend, this announcement has kept the token rising and created enough interest around it.

Furthermore, as more stakeholders use the protocol, this might also increase Yearn Finance’s Total Value Locked (TVL).

Is your portfolio green? Check out the Yearn Finance Profit Calculator

As of this writing, Ethereum, Fantom, Optimism, and Arbitrum made up the $443.14 million Total Value Locked (TVL) on Yearn Finance, per DefiLlama.

This could seem little in comparison to other Decentralized Finance protocols. Yet, the TVL might see an uptick due to the upcoming debut of its LSD.