- 1INCH was the second most traded DeFi projects on the BNB chain in the last 24 hours.

- Market indicators and on-chain metrics were bearish and initiated the price decline.

1inch Network [1INCH] announced an update for its RabbitHole on 23 February. For the uninitiated, RabbitHole is a custom RPC feature that protects Metamask users from front-running, directly within the 1inch user interface. Now, with this new update, user protection will now include Uniswap liquidity providers in addition to 1INCH swaps.

1/ ???? Meet the latest #1inchRabbitHole update!

????️ Now, user protection extends beyond #1inch swaps to cover @Uniswap liquidity providers, as well.#crypto #DeFi #Uniswap #UniswapV3 pic.twitter.com/C3JiRaXpIe

— 1inch Network (@1inch) February 23, 2023

How much are 1,10,100 1INCHs worth today?

This update helped 1INCH maintain its popularity. According to CoinGecko’s data, 1INCH was only second to FLOKI on the list of the most traded DeFi projects on the BNB chain in the last 24 hours. Interestingly, DappRadar revealed that 1INCH ranked third in terms of top DeFi dApps by volume, which was commendable.

????Most Traded Highlight #DeFi Projects in #BNBChain Last 24 Hours????

???? $FLOKI @realflokiinu

???? $1INCH @1inch

???? $CAKE @pancakeswap$HIGH @highstreetworld$LINA @LinearFinance$CHESS @tranchess$WOO @WOOnetwork$FIS @Stafi_Protocol$TWT @trustwallet$BAKE @bakery_swap#BNB #BSC???? pic.twitter.com/IqmEkHHa3M— BSCDaily (@bsc_daily) February 23, 2023

However, none of these updates reflected on 1INCH’s daily chart, which was painted red. As per CoinMarketCap, 1INCH’s price declined by 2% in the last 24 hours, and at the time of writing, it was trading at $0.6175 with a market capitalization of over $489 million. Not only the price but 1INCH’s volume also registered a decline of nearly 40% during the last day.

Concerns remain for 1INCH

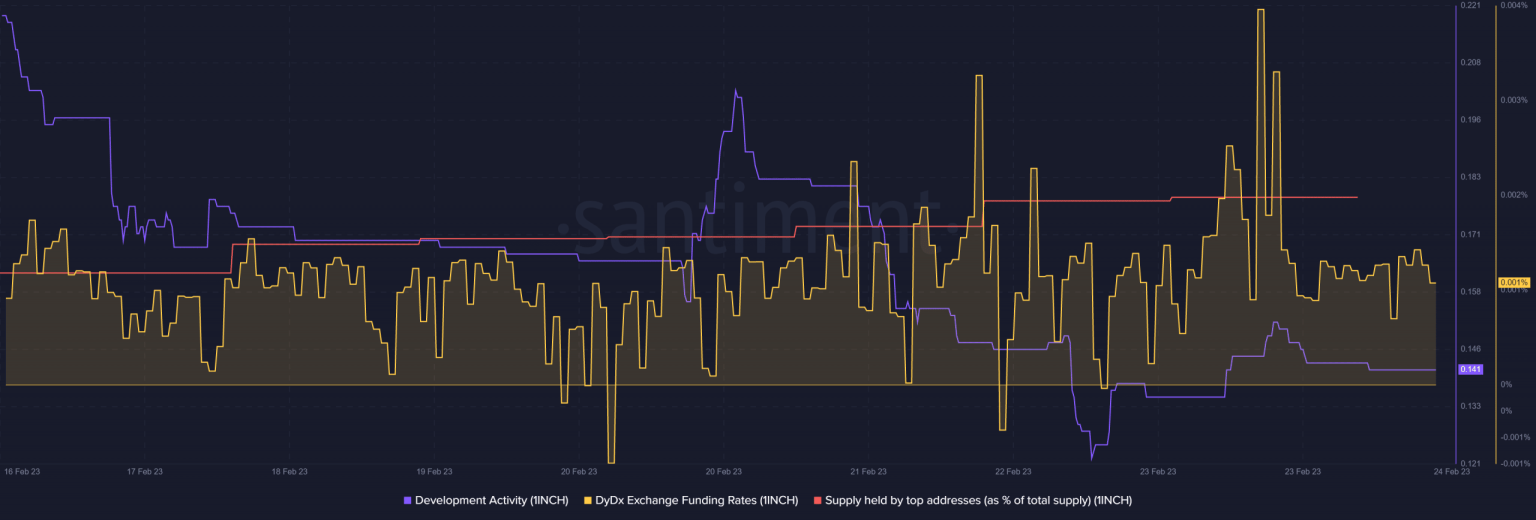

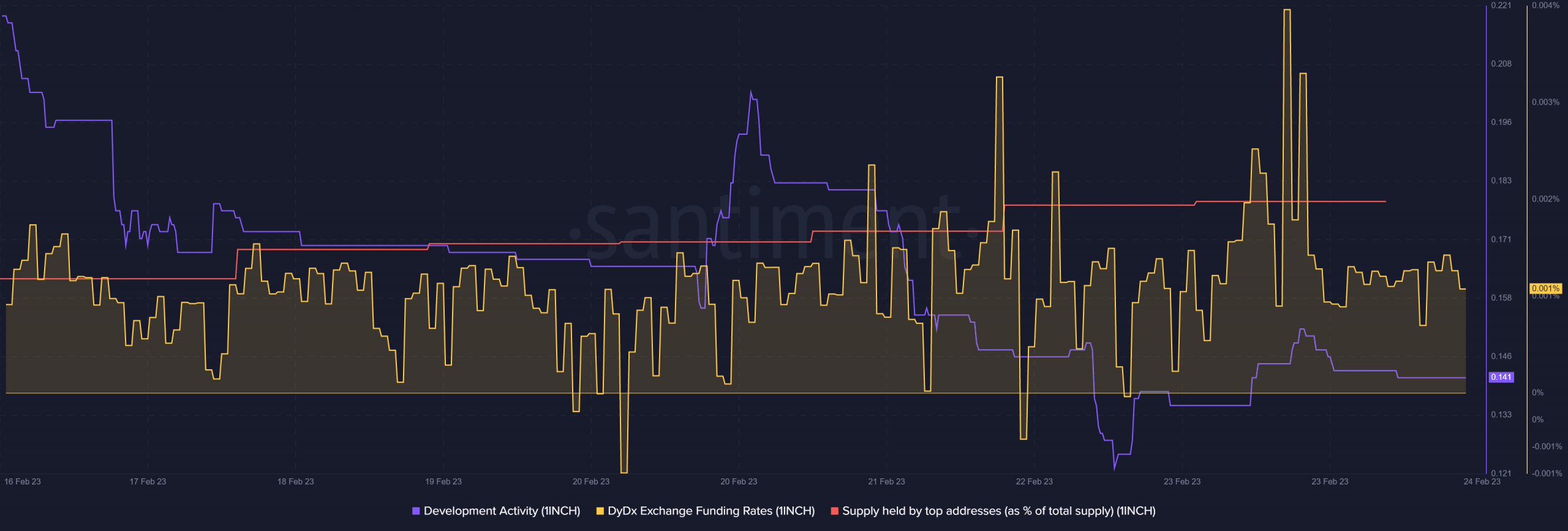

CryptoQuant’s data revealed that 1INCH’s exchange reserve was increasing, which indicated high selling pressure. The number of active addresses on 1INCH has also decreased, indicating fewer network users. The development activity of 1INCH has decreased over the last seven days, which is also a negative signal for a blockchain because it represented less effort by developers to improve the network.

However, accumulation seemed to have increased as 1INCH’s total supply held by top addresses went up slightly. In addition to that, despite the price plummet, its demand in the derivatives market increased as its DyDx funding rate registered an uptick in the last few days.

Source: Santiment

Realistic or not, here’s 1INCH market cap in BTC’s terms

The bears are here to stop the uptrend

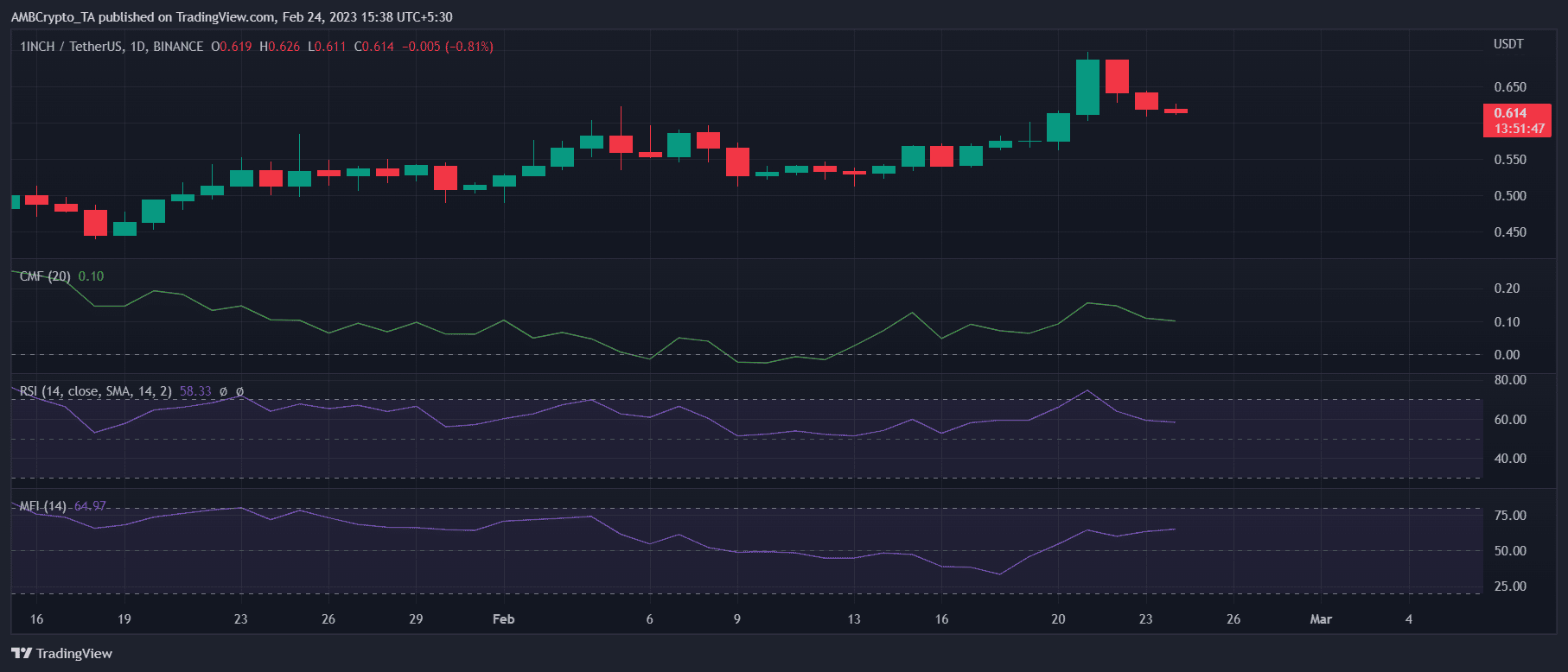

A look at 1INCH’s daily chart suggested that the bears have entered the market and might restrict 1INCH’s price from moving up in the coming days. For instance, the Relative Strength Index (RSI) registered a downtick and was headed towards the neutral mark.

1INCH’s Chaikin Money Flow (CMF) also followed a similar pattern as it went down slightly. Nonetheless, the Money Flow Index (MFI) was bullish as it was headed further up from the neutral mark of 50.

Source: TradingView