Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- FIL rallied almost 40% in the past seven days.

- Uptrend momentum could slow after hitting a crucial September resistance level.

Filecoin [FIL] continues to post daily and weekly double-digit hikes. At press time, it rallied by 40% in the last seven days, according to Coinmarketcap. However, it faced a crucial resistance level in September 2022 that could undermine the uptrend momentum.

Read Filecoin’s [FIL] Price Prediction 2023-24

In other new developments, FIL aimed to launch a Filecoin Virtual Machine (FVM) on 1 March, allowing it to offer smart contract capabilities. Such an upgrade could boost the token’s value in the long run.

FIL hit the $6.809 resistance level – Will bears take advantage of the obstacle?

Source: FIL/USDT on TradingView

So far, the recent rally has allowed FIL to recover its losses. FIL shrunk by over 75%, dropping from $11 in August to $2.5 in late December 2022. But it broke above the downtrend line in early January 2023 and flipped the market structure to bullish.

At press time, FIL was bullish on the daily chart with an RSI value of 70 – an entrance to the overbought territory. Notably, the territory is a ripe condition for a potential price reversal. Besides, FIL hit a crucial September resistance level of $6.809, which could give bears an opening to enter the market.

How much are 1,10,100 FILs worth today?

If bears gain leverage, they could devalue FIL towards $6.561 or $6.387. Short-sellers could use these levels as short-selling targets for gains. However, an extended drop below the uptrend line will flip the structure to bearish.

Invalidation of the price correction will occur if FIL’s daily candlestick close above $6.809 and confirms the uptrend. Such a move could give bulls exceptional leverage to target the $8-$11 zone, a 66% potential hike.

There were no immediate resistance levels during FIL’s rally beyond $6.8 in August 2022. Ergo, bulls could move smoothly if the trend repeats.

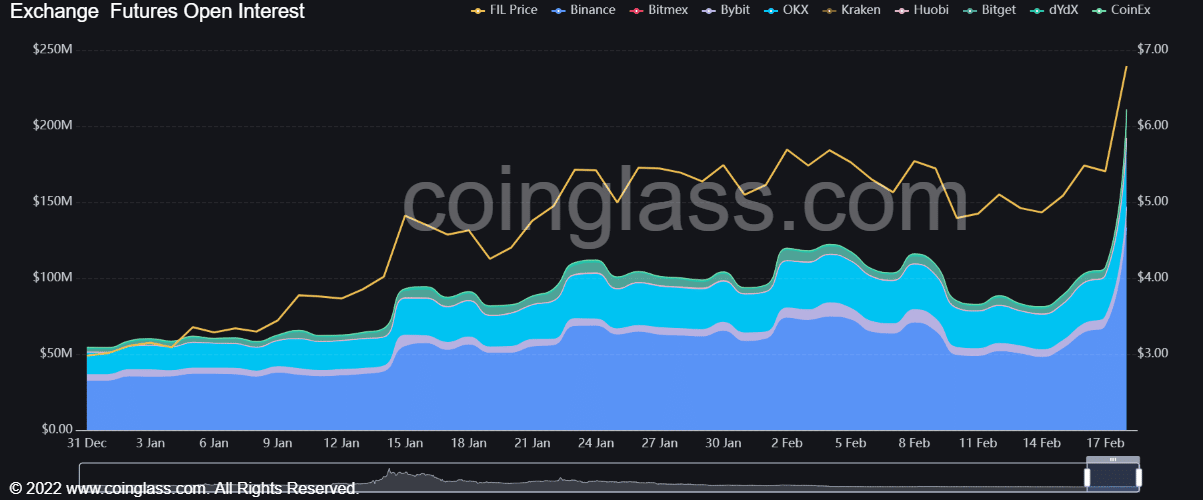

FIL’s open interest rate surged as massive short-positions got rekt

Source: Coinglass

According to Coinglass, FIL saw an increase in open interest (OI) rate, denoting increased demand and bullish sentiment in the futures market. A cross above $7 alongside a continued sharp rise in OI could give bulls leverage to target $8 or $11 in the next few hours or days.

In addition, $2.5M worth of short-potions were rekt in the past 24 hours, according to Coinalyze. This denotes the underlying bullish sentiment at press time.

Interestingly, about $800K long-positions were also rekt in the same period; hence, caution is advised.

![Filecoin [FIL] hiked by 40%, investors can benefit from these levels](https://patrolcrypto.com/wp-content/uploads/2023/02/pasted-image-0-10-1-1536x874.png)