- ADA’s price action was bearish in the last 24 hours.

- A trend reversal was possible, as market indicators were bullish.

Input Output Global (IOG), Cardano’s [ADA] developer, recently announced that its proof-of-concept EVM sidechain public testnet went live for developers to begin testing.

This latest launch will allow developers to connect their wallets, transfer test tokens, and deploy Solidity smart contracts and DApps.

ICYMI: The proof of concept #EVM sidechain public testnet is now available for developers to begin testing. Connect your wallet, transfer test tokens, deploy Solidity smart contracts and DApps, play around, & have fun!

See the documentation to get started https://t.co/3yKHgIorwA pic.twitter.com/pAnpcJ8wvZ

— Input Output (@InputOutputHK) February 16, 2023

Read Cardano’s [ADA] Price Prediction 2023-24

In addition to the launch of the EVM sidechain public testnet, IOG also announced that its Plutus Pioneer Program will start on 20 February.

The new program will come with new features and content, along with an easier development setup. These new and upcoming launches appeared to be promising for the Cardano ecosystem, as they provided an architecture to contribute significantly to the network’s value.

????Our fourth #Plutus Pioneer Program will start on February 20th with new features and content, as well as an easier development setup. ????

— Input Output (@InputOutputHK) February 16, 2023

Valentine upgrade went well?

Apart from the aforementioned announcements, Cardano recently pushed its much-awaited Valentine upgrade.

After the launch, ADA’s price gained upward momentum as its weekly price increased by more than 10%. According to CoinMarketCap, at the time of writing, ADA was trading at $0.3936 with a market capitalization of over $13.6 billion.

However, the bullish sentiment changed in the last 24 hours, as ADA’s daily chart was red. A look at ADA’s on-chain metrics revealed a few factors that might have played a role in the recent downtrend.

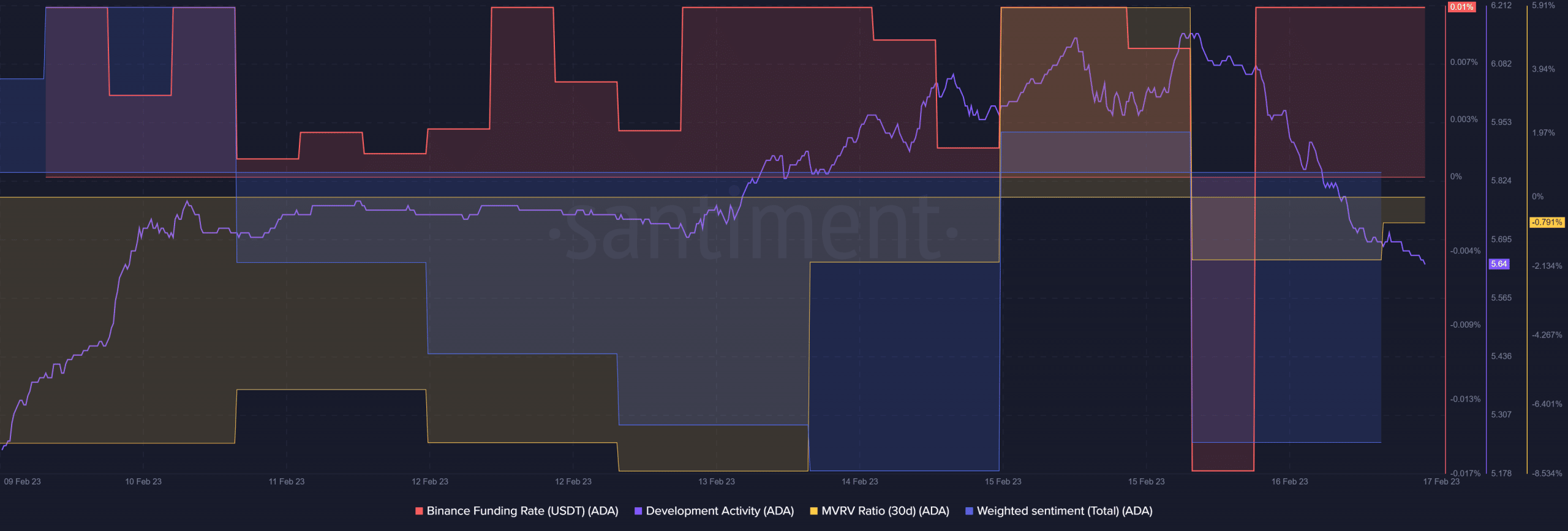

For instance, after the Valentine upgrade, ADA’s development activity declined, which was a negative signal. Its MVRV Ratio also registered a downtick.

Moreover, ADA’s weighted sentiments were also negative. Thus, reflecting bearish sentiment in the market. ADA’s Binance funding rate also plummeted in the last few days, but it managed to regain its demand from the derivatives market, which was a positive update.

Source: Santiment

Is your portfolio green? Check the Cardano Profit Calculator

The coming days can bring better news

Though the last 24 hours did not align with the best interests of investors, the coming days can bring good news, as suggested by several of the market indicators.

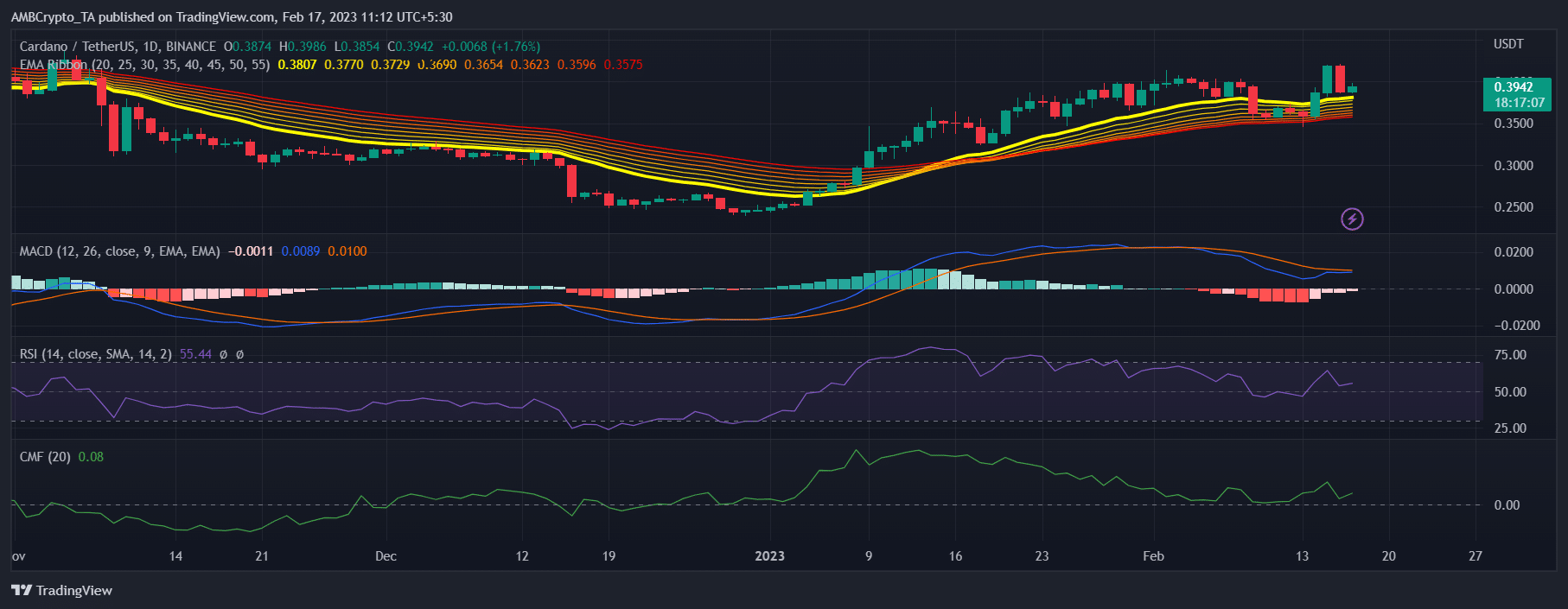

The MACD displayed the possibility of a bullish crossover. Apart from that, ADA’s Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both registered slight upticks and were headed further above the neutral mark, which was bullish.

The Exponential Moving Average (EMA) Ribbon also remained bullish as the 20-day EMA was well above the 55-day EMA.

Source: TradingView

![Reasons why Cardano [ADA] can soon beat the bears in the market](https://patrolcrypto.com/wp-content/uploads/2023/02/Cardano-ADA-11.06.49-17-Feb-2023-1536x520.png)